The product code used in the query must be the code of the destination country. Usually, the first 6 digits of the code are consistent from country to country, while the last 4 digits vary from country to country, so it is recommended to enter the first 6 digits and then query according to the specific product description.

There are different ways to find out what the import duties and tariffs are for commodities purchased from China.

China Ministry of Commerce Foreign Trade Practice Inquiry Service

http://wmsw.mofcom.gov.cn/wmsw/

This website, already known as a foreign trade nanny.

– Providing import and export taxes and fees for 88 countries/regions worldwide.

– 48 countries/regions regulatory conditions.

– 55 countries / regions tax and fee calculation.

However, there is a problem with this website query, that is, for the U.S. tariff products imposed on China, because of the batch of these products, there are exemptions, exemptions expired and extended, so the tariff response of some products is not too timely. For this part of the product, we will focus on solving the problem when we introduce the U.S. import tariff inquiry next.

On the other hand, some buyers need the tariff rates found on the official website of their own country. At this time, we need to go through the following official inquiry channels of these countries

Tariffs in United States

a, HTS code and tariff inquiry

Enter the first six digits of our HS CODE, then according to the product description, you can find the corresponding U.S. local HTS code.

For specific products, you can see that there are several columns at “Rates of Duty”, which column should I look at?

“General” in “1” refers to the tariff of most of the products imported from the world (including China), “Special” refers to the import tariff of countries with relevant FTAs with the United States (often free, but that is not for us to enjoy).

“2” refers to the import tariffs of special countries (such as North Korea) that have no trade relations with the U.S. and whose trade is restricted.

So, we are looking at the “General” tariff rate.

If the product is in the list of products with tariff increase from the US to China, you will see a small “/”, click it and there is a special list to enter the tariff increase list.

b, How to check the tariff increase products

https://ustr.gov/issue-areas/enforcement/section-301-investigations/search

As we mentioned above, since the United States has listed four tariff increase lists for our products, there were several exemptions later, and several extensions after the expiration of the exemptions. Make a lot of foreign trade people already do not know whether their products in the end is a tax increase or not.

You can search for the 8-digit HTS code in the official query site given by the Office of the U.S. Trade Representative to confirm whether the product is shot.

Tariffs in EU

https://ec.europa.eu/taxation_customs/dds2/taric/taric_consultation.jsp?Lang=en

One of the most important aspects of EU trade policy is the customs union. Products imported from third countries are subject to the same import tariffs, regardless of the country in which they enter the EU.

Now that the UK has left the EU, the 27 countries of the EU are: Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Croatia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Romania, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden.

Tariffs in United Kingdom

https://www.trade-tariff.service.gov.uk/sections

When the UK was a member of the EU, it automatically participated in 40 trade agreements with more than 70 countries or territories. After Brexit, the UK can negotiate the continuation of these agreements. Any existing EU trade agreements will no longer apply to the UK after 31 December 2020, and the UK will follow WTO rules if it has no bilateral agreements with these countries or regions.

From January 1, 2021, the UK will implement a new tariff system, the UK Global Tariff (UKGT), which will be simpler and have lower rates than the EU Common External Tariff.

Import Tariffs in Russia

http://www.russian-customs-tariff.com/

According to the chapter and description to confirm the tariff.

Duties and Taxes in Japan

https://www.customs.go.jp/english/tariff/2021_1/index.htm

Latest version in January 2021, again, check by tariff, look at the column of WTO member countries’ tariff rates.

Japan will no longer grant GSP tariff preferences for Chinese goods to Japan from April 1, 2019. What is worth looking forward to, however, is that RCEP makes a historic breakthrough by making the first zero-tariff agreement arrangement for a free trade area between China and Japan. Once RCEP takes effect, Japan is expected to exempt 86% of Chinese goods from import tariffs.

Tariffs in Egypt

https://www.customs.gov.eg/Services/Inquiries/Tarrif

This site is in Arabic and can use Google Chrome to translate the page, or just do a search.

Taxes in Nigeria

https://web2.customs.gov.ng/?page_id=3133

Find product tariffs by section for the corresponding code.

Import duties India, Korea, Australia, ASEAN countries

http://fta.mofcom.gov.cn/ftanew/taxSearch.shtml

The import tariff rates of these countries for Chinese products can be found on the China Free Trade Zone Service website, as they are all countries with which China has relevant FTAs.

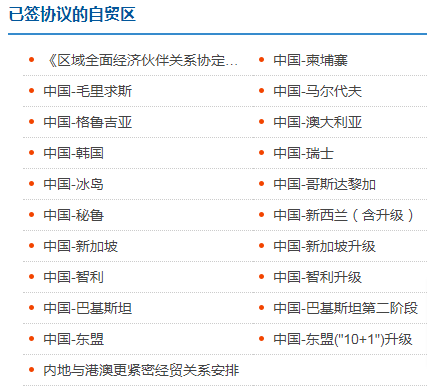

At present, China has signed the following FTAs.

Among them, ASEAN countries include: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam.

In January 2010, the China-ASEAN FTA was officially completed. Ten years later, tariffs on 7,000 products have been eliminated within the framework of the China-ASEAN FTA, and more than 90% of goods have achieved zero tariffs.

India, Bangladesh, South Korea, Sri Lanka and Laos are in the APTA.

The latest development is that on October 23, 2020, the APTA Secretariat notified the member parties that Mongolia has deposited its instrument of acceptance with ESCAP, completed the accession process, and intends to mutually implement the tariff concession arrangement with the member concerned on January 1, 2021.

Under the tariff concession arrangement, Mongolia will reduce tariffs on 366 tariff lines, mainly involving aquatic products, vegetables and fruits, animal and vegetable oils, mineral products, chemical products, timber, cotton yarn, chemical fibers, machinery products, transportation equipment, etc., with an average tariff reduction rate of 24.2%. At the same time, Mongolia can enjoy the existing tariff concession arrangements of other members such as China.

Anti-dumping, countervailing

http://cacs.mofcom.gov.cn/index.shtml

The last one, the specific situation of anti-dumping and countervailing for China’s products by countries, can be checked here.

3 thoughts on “10 Ways to Find Out How Much Tariff to Import Commodity from China”

I was very happy to discover this website. I want to to thank you for your time due to this fantastic read!! I definitely liked every little bit of it and i also have you book marked to check out new things on your blog.

Thanks for your blog, nice to read. Do not stop.

Hello, always i used to check weblog posts here early in the daylight, because

i enjoy to gain knowledge of more and more.